- HOUSEHOLD BUDGET FULL

- HOUSEHOLD BUDGET TV

HOUSEHOLD BUDGET FULL

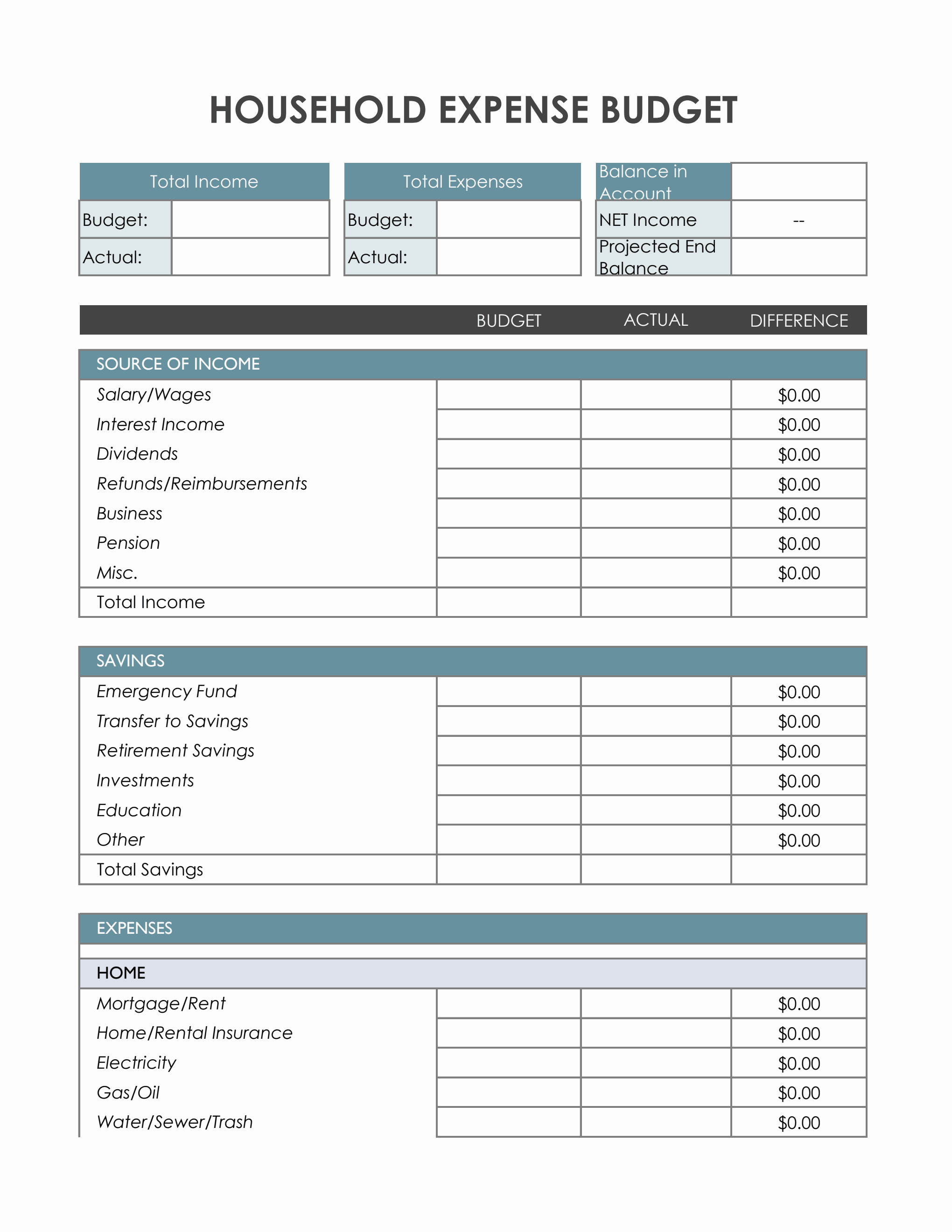

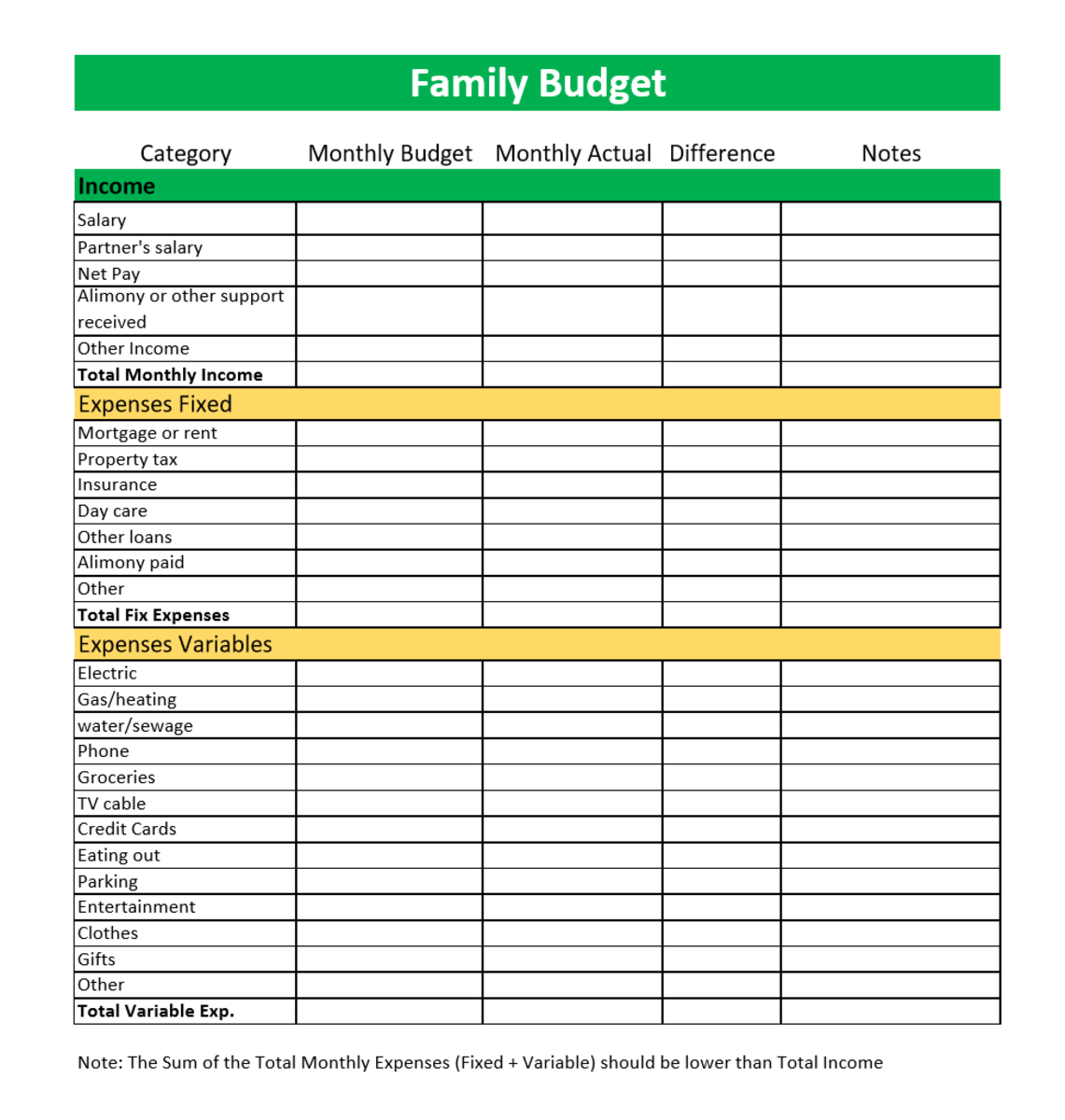

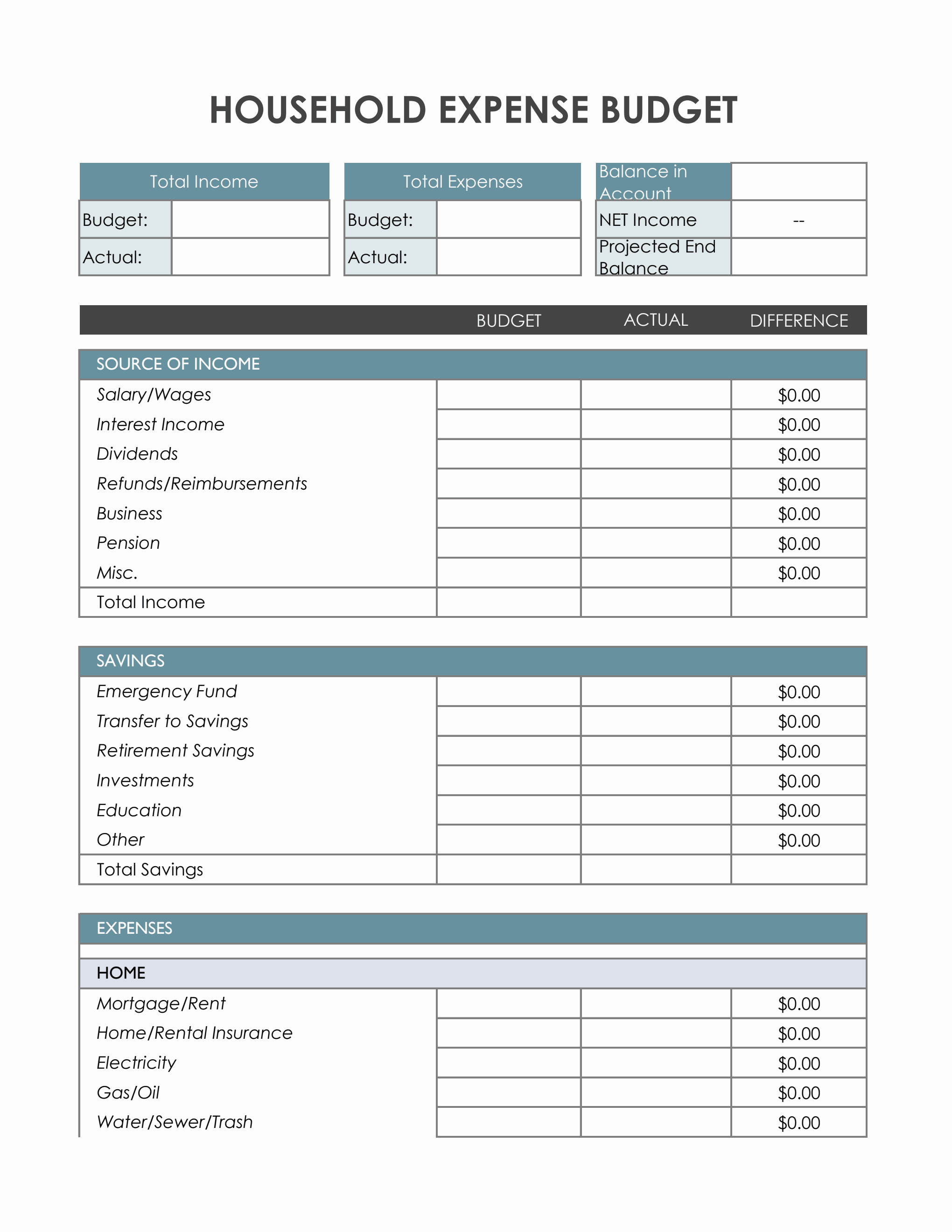

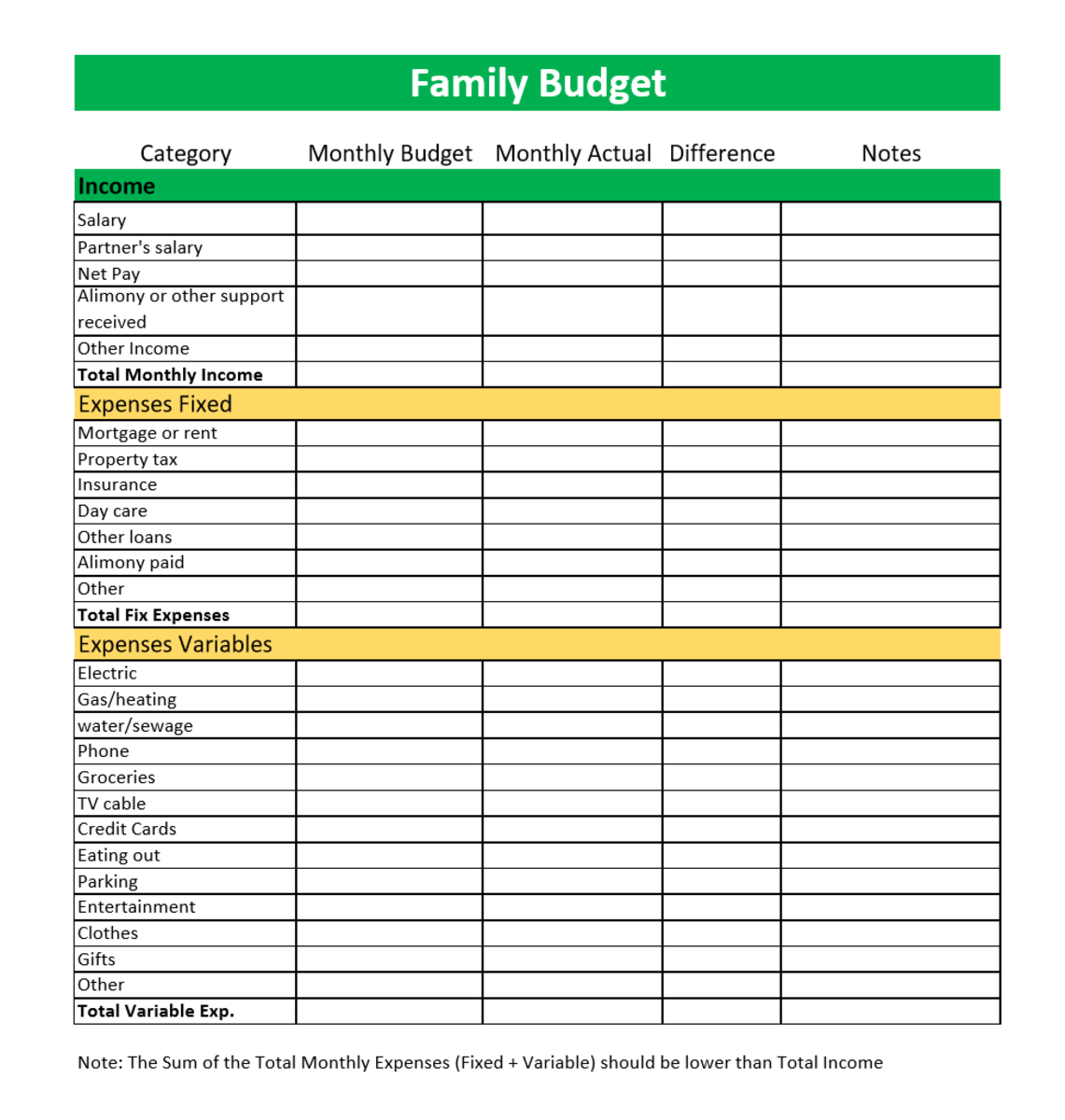

Placing the items in categories will give a full picture of your finances and money management. You may want to increase or decrease it according to your circumstances or needs. Now’s the time to make adjustments so you can reach the amount you want to save.If the result is negative, take a close look at the budget and think about why you’re spending more money than you’re bringing in. Any spare money is how much you’re able to save. Now that you’ve categorized your budget, work out the difference between your income and expenses to determine your household's financial balance.To find out more about the importance of saving, read this post by Santander Consumer Finance. Include a section on how much of your income you want to put away each month.

HOUSEHOLD BUDGET TV

To help you organize, you could use these categories: income (such as salary and benefits), fixed costs (like water and electricity), essential variable costs (repairs) and unnecessary or “ant” expenses (pay TV or eating out). In the same document or tool, detail each movement performed in a month.Whatever the format, the next step is to break down each item so they are orderly, clear and easy-to-find. To find out more about the available tools, check out this post by Santander Consumer España. Record them in an Excel spreadsheet or whatever tool you’re planning to use (like an app).

That means every income and expense, with no exceptions.

First, gather every piece of information on the household’s finances, like bank statements, payslips, purchase receipts, fixed costs and debts. To learn more, read this post by Finanzas para Mortales (Finance for Mortals). By planning ahead like Marina’s family, we can have a better idea of how far our money will go. Household budgets often serve as a means of knowing how much we’re able to save. The outcome is a limit to what we can spend each month to make sure we achieve our goal, which isn’t always necessarily a purchase. Now she knows how much money she has to start looking for somewhere new.ĭrawing up a budget means planning every income and expense over a set period. She makes a list of her income and expenses, including all move-related costs: removal service, refurbishments, cleaning, new furniture, home insurance, selling her current home. Marina grabs a calculator and gets to work. Essentially, what's María’s budget for moving house? If they do take the plunge, she needs to know what house size and which neighbourhoods fit into her price range. It’s the amount we need to achieve a goal like refurbishing the kitchen, getting married, renting a home, buying a motorbike, changing car or making our savings target.Ī case study: Marina and her family want to move to a bigger apartment, but she’s not sure they can afford it. Santander International Banking ConferenceĪ calculation of the money needed to cover prior known expenses. Rules and Regulations for the General Shareholders' Meeting. Rules and Regulations of the Board of Directors. Policy on Communication and Engagement with Shareholders and Investors.  Annual report on directors' remuneration. Offer to acquire outstanding shares and ADSs of Banco Santander Mexico (November 2021). Significant equity shareholdings and treasury stock. Issuance Companies Financial Statements. Acting responsibly towards our customers.

Annual report on directors' remuneration. Offer to acquire outstanding shares and ADSs of Banco Santander Mexico (November 2021). Significant equity shareholdings and treasury stock. Issuance Companies Financial Statements. Acting responsibly towards our customers.

Argentina Brazil Chile Germany Mexico Poland Portugal Spain United Kingdom United States Uruguay Directory

0 kommentar(er)

0 kommentar(er)